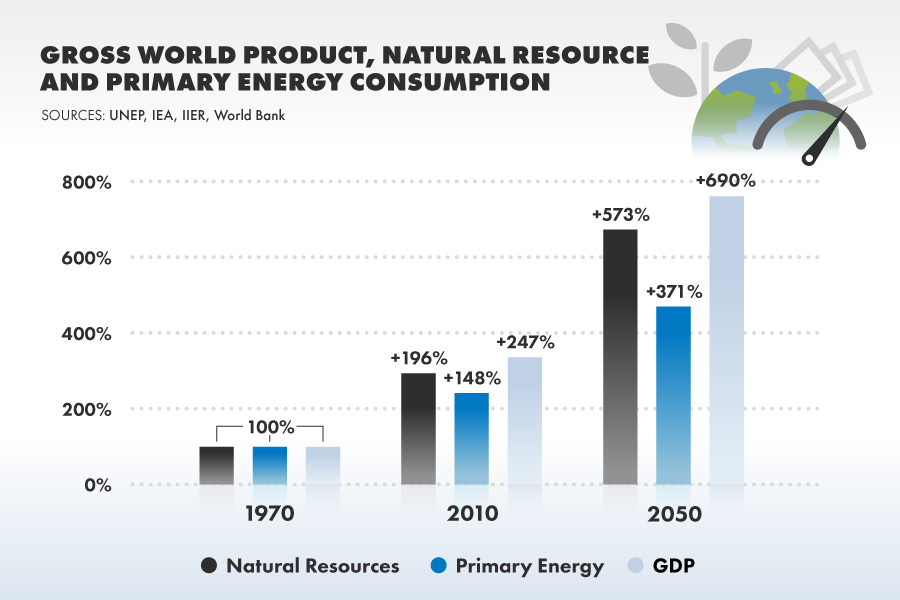

Two percent is the minimum growth rate predicted by almost every institution for the global economy until the year 2050. While this doesn't sound like much, we now know that 35 years of 2% growth translate into a doubling of economic output, which also almost doubles our energy and resource consumption, at least if we improve our efficiency at the pace of the recent past. There is limited reason to believe this will change as we have explained. Now we want to understand how and why economic science got to the impression that we could grow at that (or an even faster) pace forever.

Past experience drives future expectations

The reason behind this assumption is the same as for us ordinary people: For over 200 years, except for a few short-term bumps, the world economy has indeed been growing at an amazing pace. And with our brains wired to use past experience to define rules for the future, it is not surprising that economic theory has come up with a world view that sees our economic systems expanding forever at high speed.

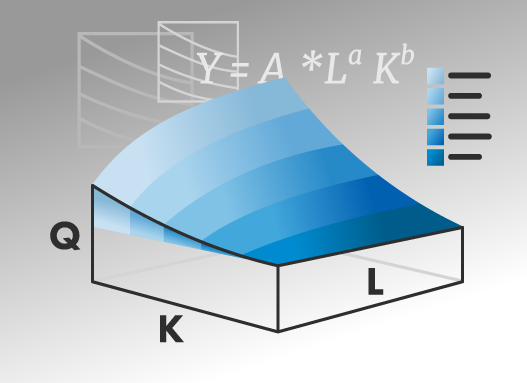

Based on that long-term experience of continuous growth, 20th-century economists revised older economic theories (.e.g by Adam Smith) tied to finite land availability and productivity with models built on variables that theoretically have no limits. The most common concept, which is used for almost all relevant economic predictions not only by economists, is the one driven by the so-called Cobb-Douglas production function. The idea assumes that if we grow two key inputs of production, labor and capital, while improving their productivity, our economic output will grow.

Labor, capital, and productivity are not independent variables

Once we understand that more (low-cost) energy and natural resources are a fundamental requirement to increase economic activity, this world view comes across as a bit shortsighted. During the past 200 years, when fossil energy and other natural resources were available without limits, and with continuous improvements in technology and better ways to find and explore new sources and more uses, we had no limits imposed on us from a resource perspective, which is why that simple (Cobb-Douglas) formula seemed valid. Until recently, that is.

When dissecting growth more closely over the past centuries, we can conclude that those variables were not representing reality. In scientific terms, labor, capital, and factor productivities largely depend on resource and energy availability and productivity. Or differently put: Until there was no limit to energy and natural resources, the Cobb-Douglas equation worked well; once limits kicked in, we can add humans and capital as much as we like, yet output rises little, if ever – or we get hungry humans and empty factories.

This principle is easiest to understand when taking a step back: If there isn't enough food to feed the workers or not enough energy to run the factory, or some resource inputs missing, there will be no new car, no matter how great workers and factories are. Or, in realistic terms for today’s world: If finding the energy and natural resources becomes more cumbersome, it becomes more difficult to add economic output to an already large and complex economic system.

Doesn't that sound familiar? Haven't we recently read about a big youth unemployment problem around the world, which seems to have no solution? And haven't we also seen that large corporations keep hoarding large amounts of cash or paying it back to shareholders, lacking good investment opportunities? These are just symptoms, but highly indicative that our traditional production function is now limited by its key underlying variables: energy and resource input and their productivity.

Ultimately, for us to grow labor and capital sustainably, we need to grow our energy and resource consumption, but as we know, it has become increasingly difficult to do so, and there won’t be enough cheap resources for perpetual growth.

Economic theory substitutes everything

The concept of "substitution" - the ability to switch between different inputs like labor and capital, or resources, as price and availability changes - is another area where economics has erected a dogma based on an incomplete view, driven by an initially correct observation. While it is plausible and obvious that a buyer reacts to supply shortages or price increases of one good, for example pork meat, by purchasing an alternative with sufficiently similar properties to satisfy the need for protein, for example chicken, this rule gets overblown as soon as economists ignore the obvious: Not everything has a meaningful substitute. A few examples: You can't grow plants without water, nitrogen, and phosphorus. And you can't economically erect buildings without some key materials like concrete, timber, steel, copper, aluminum, and many others.

After 2008: Limited success to get growth back

After the financial crisis of 2008/9, enormous efforts were made to counter the downward trend that had led to the global economy shrinking for the first time in more than 60 years, and to "restart the growth engine." The objective was to get back onto the predicted growth path, based on the economics view ignoring resource and energy inputs. Despite economic stimulus , deficit spending , record low-interest rates, and many guarantees applied to markets or entities requiring support, growth targets were regularly missed - even today, after 8 years, that "growth engine" is still sputtering for most.

So far, few people in politics, the media, and the corporate world have picked up on that paradox of how little has come from all those interventions that are absolutely unprecedented. Everybody is still hoping for things to get better next year. But, unless we find something that eases the pressure on the underlying independent energy and resource variables of our economy, it won't. And as long as we keep ignoring that reality and following economic thinking based on just labor, capital, and their productivity that suggests we can rapidly double the size of our economy, we will only get into trouble down the road.

Some people say lower resource prices, which we have observed since 2015, will support a return to the old normal and are an indication we are actually not facing resource limits. Quite the contrary is true: Heavy price swings for energy and other natural resources since 2008 are a symptom of resource constraints and have detrimental effects on economic stability and investment in mining and extraction. If nobody is ready to invest in new exploration and we manage to grow global demand a little more, prices will rise quickly.

Back to the future of economics

All it takes to arrive at a more realistic view is to look out for what truly powers an economy and always has. In the old days, before the 20th-century, economists understood that we live in a finite system: It is the capacity of the land we live on that determines how wealthy we can get. For a short time - probably a few more decades if we are lucky and use less than projected – we can continue to harness land productivity of hundreds of millions of years to fuel our lifestyle - in the form of fossil fuels. But further expansion is difficult, and as soon as we have to go back to a world of land productivity based on "current" solar inputs, the limits we are talking about will become obvious. Economic theory must retrace its historic roots to be meaningful for this future.