Energy and resource limits are now inhibiting growth

Cover Story 3/4

The end of economic growth has been predicted repeatedly throughout the past 250 years, but never before has it been a present reality. Quite the contrary, whoever cried wolf was later defeated by further growth. These (sometimes premature) warnings might have added to the effect that, today, hardly anybody is listening.

But now, the situation is different, as growth is ending nearly everywhere despite our frantic attempts at reviving it, and economic limits are becoming a real threat for a growing number of people on our planet. Unless a miracle changes that trajectory, this won't go away, but will only accelerate.

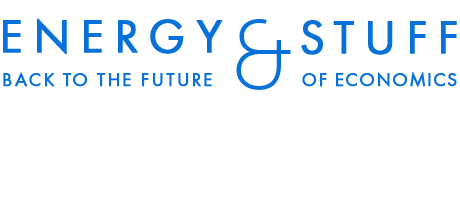

Why is that so? If we wanted to meet even the modest target of 2% global economic growth per annum for the next 35 years, by the year 2050, we would have to double our resource consumption from today. Instead of using around 82 billion metric tons in 2015, we would consume about 164 billion tons in 2050. Total energy consumption, if improved at the recent rate of 0.3% p.a., would grow by 90% from today's 13,147 MTOE to around 25,000 MTOE. And if we keep introducing renewable energy at the pace of the past 10 years, fossil fuel consumption would grow by 85%, reducing the share of fossil fuels from 86% in 2014 to only around 83-84% in 2050.

All this assumes we will improve our resource and energy efficiency at the same rate as we did recently, we don't report paper growth, and no miracle breakthrough in energy occurs. We are aware of all those very ambitious objectives to improve global energy and resource efficiency, but so far, there are no indications these breakthroughs are happening - and can happen without affecting economic growth.

However, there are three key developments that make it almost impossible to ever get to the point of doubling the global economy by 2050: the diminishing marginal productivity of new resource exploration, limits on economic benefits of consumption, and credit limits.

Marginal resource productivity is declining

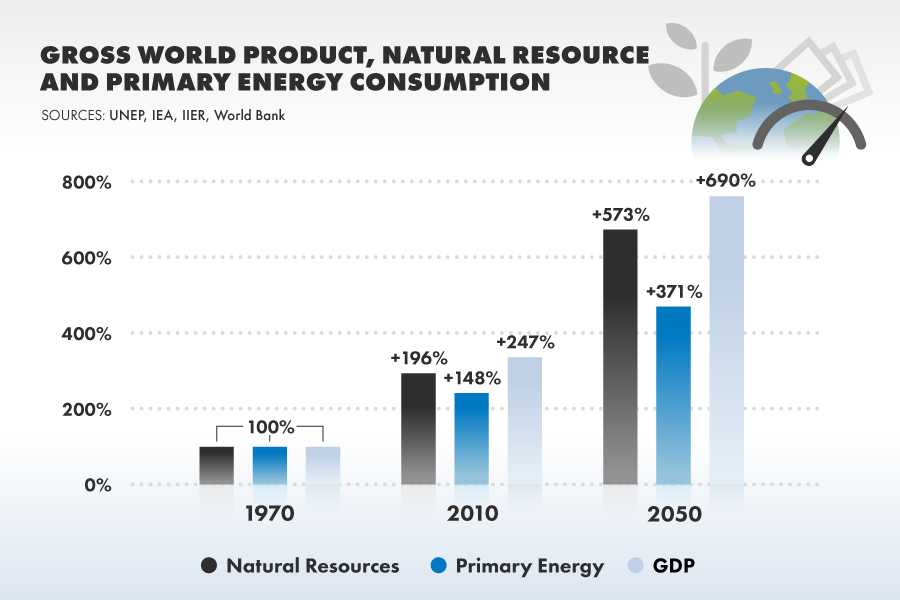

When extracting fossil energy and other natural resources, we don't really pay for everything that makes them available to us. We don't pay for the geological processes that have concentrated and enriched minerals in a way that makes it affordable to unearth them, and we don't pay for most of the damage we do when mining them, nor the damage we create when we dispose of waste. We primarily pay for finding, extracting, enriching, and transporting them to their point of final use. But on all these fronts, we are fighting an uphill battle. Extracting oil from the ocean in reservoirs up to 30,000ft deep is obviously more difficult than drilling a hole on land, where oil just seeps from rocks close to the surface, and mining copper from deposits that contain only a tiny fraction of the shiny metal makes us move and crush much more rock, and create much more landscape damage. Numerous examples exist, where we increase the effort to get additional, less rich mines and fields into production.

To stick with copper: In 2015, global copper was produced from ores with 0.65% copper content, an all-time low. In U.S. mines, ore grades are even lower at around 0.4%. The more we want to extract, the more effort is needed to tap into lower quality marginal sources, which reduces economic benefits.

How small or big those benefits become from using natural resources largely depends on the effort required to obtain them. The more we have to invest into getting the inputs, the less will be left for running the "machine" of industrialized societies. With increasingly lower marginal benefits from newly mined sources, our economies are bound to become smaller, not bigger.

Consumption reduces resource benefits

Fossil fuels and their usability to convert high-quality natural resources into useful goods has enabled our current lifestyle. To imagine the process we have been experiencing, we can use the analogy of invisible "helping hands" assisting us in whatever we do. Just like a draft animal uses additional solar energy from grazing to help improve crop output on a farm, a machine doing work for us in a factory channels past solar energy (in the form of fossil fuels) to support a lifestyle we could never accomplish with our bare hands or the help of a mule.

During the first 200 years after the industrial revolution, many of those benefits went into the creation of infrastructure that truly furthered growth. Machines, factories, railroads, roads, telecommunications networks, better housing for everyone, better hospitals and schools were investments into the ability to create more economic output. During the past decades, though, we have increasingly shifted away from investment towards consumption. In the U.S., for example, the GDP share of household consumption rose from 58% in 1970 to 69% in 2015. Buying more clothes than our closet can hold, having more toys than our kids can ever play with, getting a new smartphone every year, or having that bigger house or car that just feels better, but does essentially the same as the previous one, are only creating value (measured as GDP) when they get manufactured and purchased, but not afterwards. That way, we are increasingly shifting away from the creation of multipliers to one-off benefits. It is like if we tried to keep a fire going with matches alone.

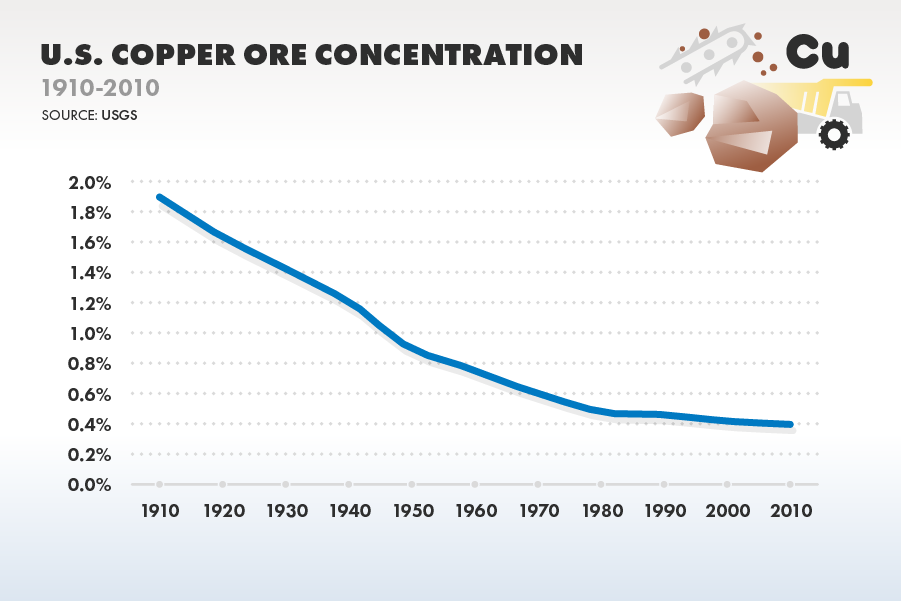

Debt limits are adding to the problem

On top of the physical limits we are experiencing, we are facing further headwinds from financial markets. As a side effect of increasing consumption over investment, almost all economies have grown their financial obligations much faster than their income (measured as GDP). This is as if your own family gets deeper into debt each year, while your income grows much more slowly. And that’s exactly what has happened: On average, each household, each country, and each company today owes more, relative to their income, compared to 30 or 40 years ago. It is very hard to imagine that we can continue growing debt levels, particularly because we are already experiencing the lowest interest rates in history, which temporarily gave us more room to breathe by reducing the debt service burden on households, companies and governments. In the United States, households have already experienced these limits since the financial crisis of 2008, and overall credit availability for private individuals has shrunk. But without growing debt, the ability to invest and consume remains limited.

Adding renewable energy complicates things

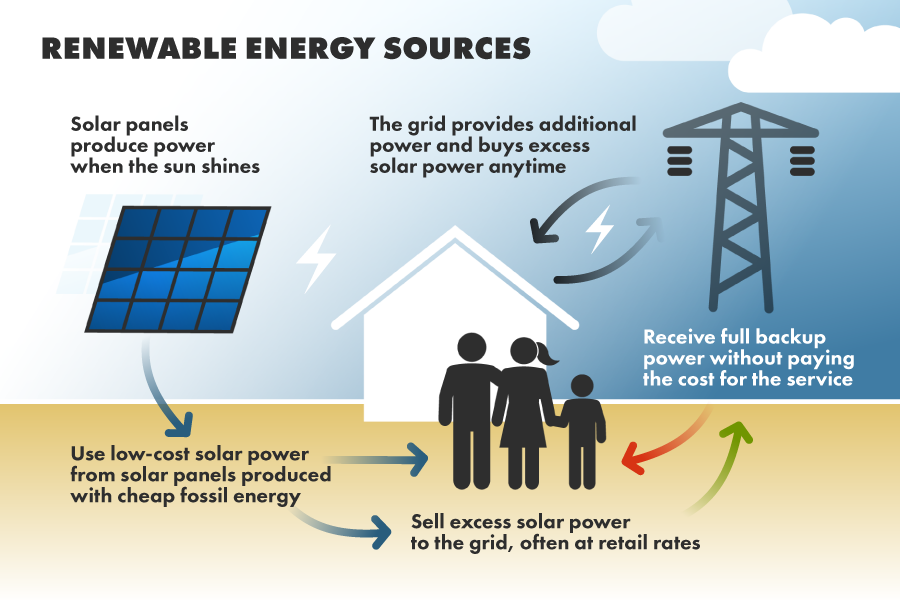

Many people hope that rising prices of natural resources and energy will benefit a transition to renewable energy sources. So far, introducing wind and solar - the two most relevant renewable alternatives - has only happened in places with large subsidies or government mandates or at least some imbalance in cost attribution of the overall system. For example, people who produce solar electricity on their roof at a rate that compares favorably to the power charged by their utility receive the reliability of the power grid for free, giving them as much electricity as needed at times when their solar panels don't produce enough. Often, their utility is also buying back excess solar energy at above-market prices. This works well as long as solar power (or wind turbines) have a relatively small market share like today, once everyone produces their own power when the sun shines, getting grid services for free is no longer feasible.This demonstrates a problem almost all energy sources that are driven by "current solar power" have versus those driven by "prehistoric solar power": the latter are available as stores, ready to unearth and to burn when we want to use them, whereas the former come with the weather, demanding a lot of extra effort to convert them into useful energy flows to our societies. Given these constraints, we consider it unlikely that current solar flows will ever become as beneficial as the easy fossil fuels we were burning during the 20th century.

This might also explain why we have - despite commitments to the contrary - been notoriously bad at adding renewable technologies. So far, in every year except for 2009, when the global economy and thus energy use shrank by 2%, total fossil fuel consumption grew faster than renewable energy use. If we continue to add renewable energy sources at the pace of the past 10-15 years, we will only reduce the share of fossil fuels from 86% of global raw (primary) energy consumption in 2015 to about 83-84% by 2050. If we try to do more, we will face problems with scaling up that will also impact the ability of our economies to grow.

The farm’s growth potential is exhausted

What is taking place today is rather simple: If we think back to our initial example of a farm, we are doing almost everything we can to increase crop output, but we are no longer harvesting heaps more every year as we used to. We can make big efforts, such as bringing in the latest machinery, even more fertilizer or more helping hands in order to squeeze out a little bit, but at a high cost and with unsatisfying results. And now, they are even taking some of our fancy tools and machines away.

Since 2008/9, nothing has been normal for economics, because we are at a point where growth becomes almost impossible. Compare it with when you have stretched a rubber band to its maximum length. Pulling it further becomes harder as the force against your pull is strengthening, and it is only a matter of which will give: you, because the rubber is stronger, or the band when it snaps. The best alternative is to recognize the situation and reduce the pull.

Our brain is looking backwards for guidance

When planning for the future, it has always been useful to look at the past for guidance. This has been great advice for most of human history, as throughout 99.9% of our 200,000 years on this planet, with the exception of the past 250, changes have been very slow to arrive, except for sudden events like natural disasters. Those hunters and gatherers who took the beaten path were much more likely to return home than those who ventured into the unknown parts of the jungle, looking for new discoveries and adventures. Out of 100 people who took the risk, one might have returned rich, while 99 never made it back.

For many people alive today, the dominating experience was that next year will likely be better than last, and that economic growth can be taken for granted. It requires true reflection, combined with a reach into our planet's history beyond the year 1750, to understand that our current experience has been shaped by the one-time benefits of burning 500 million years of solar power that will never return once they are used up.